I’m sure by now, many of you are familiar with the NZ Government’s COVID-19 Wage Subsidy program. If you aren’t, you should head on here to learn more about it and here to find out how to apply and use it.

Now one of the biggest questions that I’ve come across in the past few days is many people asking me if it is legal for their employers (who have already applied for the subsidy) to pay them below 80% of their normal wages (say 60 or even 50 percent). You see, in the declaration for the wage subsidy, there is a clause that states that employers must use their ‘best endeavours’ in paying at least a minimum of 80% normal wages for all employees named in the subsidy application. The implication is that, if despite their ‘best endeavours’ employers cannot pay the minimum 80% of normal wages, then the employer needs to show that they indeed have done their very bestest and tried their very hardest to make that 80% mark.

But the real clincher here is:

How do you show ‘best endeavours’?

To keep it simple, let’s talk about three ways an employer can show that they have done their ‘best endeavours’:

No. 1: Have a cash flow budget

If you have read my previous article on COVID-19 Cashflow management – you would know that keeping track of your daily cash movement is important. What is even more important is using that daily cash movement to form your cash budget. Use that cash budget to forecast the amount of sales you expect to receive over the next 6 to 8 months or so.

If your business is badly affected by COVID-19, you need to be able to show, in your forecast, how that financially impacts your business. Forecasting is something you can easily do in Xero (which is still my go-to software for small business accounting). You can easily do it on excel as well.

As always, let me illustrate it with an example:

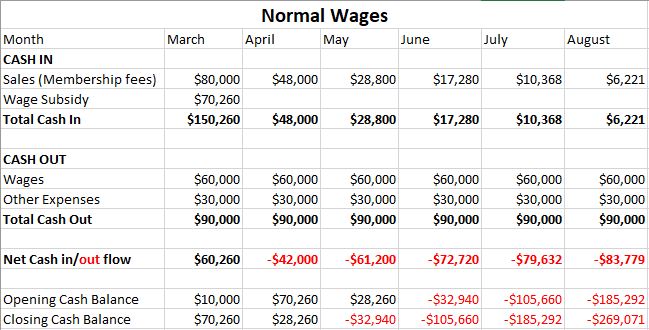

Ahmad runs a fitness gym. Due to the COVID-19 outbreak, he expects that sales from membership fees will decrease by 40% every month in the coming months due to more people wanting to physically distance themselves from each other. Ahmad has a team of 10 full timers whom he pays about $60,000 every month. Ahmad has about $10,000 in the bank for his business right now. He received $70,260 from the wage subsidies (585.50 X 10 X 12 weeks). Based on his projections, his cash budget looks like this if he were to keep paying his team their normal wages (note that other expenses includes rent, utilities, maintenance, etc – I’ve lumped them all together for simplicity):

From the cash budget – it looks like if he keeps paying them normal wages he will run out of money by May, and he might not even be able to keep his team members on through the 12-week period. That’s not good. Let’s see what happens when Ahmad drops it down to 80% of normal wages:

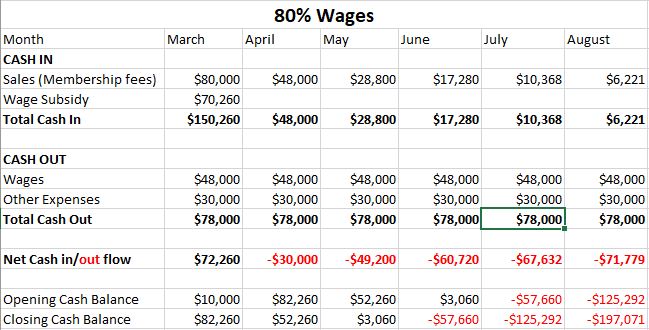

With the 80% drop in normal wages, he can push the cash out to just past May but by the end of June he will end up in the red, unless he lays off some of his team (or negotiates their employment contracts). At this point, it’s a bit risky and he may not even be able to keep all the team members on through the 12-week period.

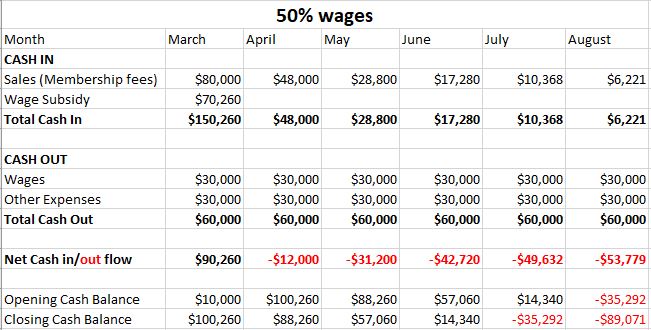

So Ahmad bites the bullet and projects a 50% drop in normal wages:

With a 50% drop he can retain his team members well past June, well past the 12 week period – hopefully by then, people will start hitting the gyms again and perhaps Ahmad can go back to paying his team members their normal salary… if not, well, if sales continue to decrease, he will be in the red by July and he may have to make some very difficult decisions by then.

So there you have it – having a cash budget is crucial in showing that you have shown very careful thought and deliberation about how you plan to use the wage subsidy and if you can keep paying all your team members at normal wages. However, having a cash budget alone is not good enough because if Ahmad forecasts a cash shortfall in the coming months, he needs to…

No.2: Talk to the banks

Talk to your banker! Not having enough cash in hand is not a good enough excuse to be paying your team members lower than their dues. You need to talk to your banker to determine what the best way forward is.

You need to ask them:

- What sort of financing is available for your business?

- Can you restructure your existing debt to improve your cash position in the coming months?

- Can they grant you a lower interest on your overdraft facility?

- Can they extend the repayment period on your business credit card?

- How much debt can your business take?

- And much more!

It is VERY IMPORTANT that you keep a record of all your communication with your banker in these coming months as this is vital evidence you can use to back up your claims should you get audited by the Ministry of Social Development.

As an employer – you want to show that you have spoken to the banks and exhausted all avenues of financing in order to pay your team’s wages. If you decide to pay below the 80% limit – you need to show that you tried your best to raise enough cash to hit that 80% mark without burdening your business with too much debt.

No. 3: Talk to your team

The most important people you need to talk about any wage paying decision is your team. Remember that whatever rate you choose to pay your team at – they need to agree to it. In writing.

Talking with your team means having the necessary documentation showing that you have spoken to your team about the business’ financial position, you have told them about your discussion with the banks with regards to applying for funding and that you have carefully considered the value of retaining them at lower pay.

Transparency is so, SO important here. Don’t hide anything. If your business is in dire financial straits – the team deserves to know. Share the cash forecasts with them. It is their business too and it affects their livelihood. They are your team, not your adversaries – so you need to share your plans with them.

If you do decide to pay them below the 80% rate, you need to have proof that you have discussed this idea with them and that they voluntarily (without any form of threat or duress) have agreed to the reduced rate. Choose your words carefully. Be sympathetic and hear out their problems first before putting forth your own.

Ultimately, if your business is ever going to bounce back from the COVID-19 crisis, it is going to be your team that helps you do just that. So treat them with all the respect and honor that you would expect them to treat you with. They ARE your business – there is no business without them.

As long as you can sufficiently prove that you have done all those three things , you should, as an employer, be able to prove that you have sufficiently used your ‘best endeavours’ in applying the wage subsidy.

I hope that this has been helpful for you in educating you in what you need to do as an employer. If you are an employee, I hope you have a better understanding of the sort of work your employer needs to put in to make sure you get paid!

Stay safe, stay healthy and stay strong!

Kia Kaha NZ!